Source: Bankrate’s annual closing costs questionnaire. Considering Bankrate, the latest questionnaire has lender charge and you will 3rd-team costs. They excludes name insurance policies, name lookup, taxes, property insurance rates, connection charge, focus and other prepaid service products.

Refinancing is just worth every penny whenever you can help save over that which you need to spend in order to re-finance. Might break-even on the refinancing when the pricing to re-finance translates to this new discounts you expect to get. Here’s how to help you imagine the point at which you break-even and past.

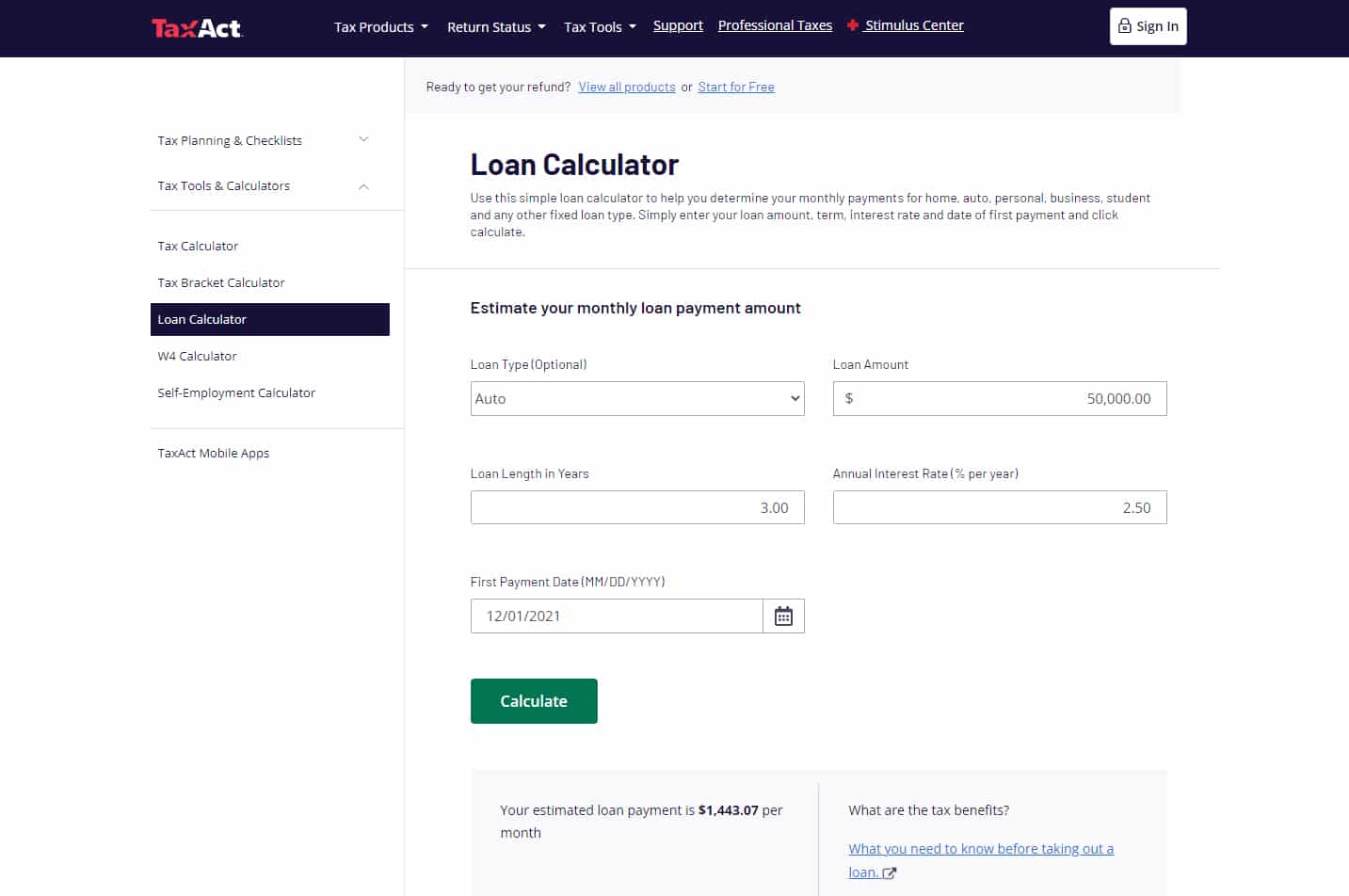

Use a beneficial re-finance calculator. Re-finance hand calculators account fully for the difference when you look at the attention will set you back – not only the real difference during the payment – and so they can display your correct deals even if the the loan has a higher percentage compared to old you to.

Utilizing the small, dirty, and you may hazardous way, their re-finance looks in this way: If this will set you back $step 3,five-hundred so you can re-finance, as well as your the new commission was $70 a month lower than the existing fee, new estimated split-also are 50 days ($step three,five hundred / $70), or couple of years and two days.

Understand that while the short, dirty, and you will harmful strategy is easy, it might along with force you to the incorrect conclusion. That’s because the essential difference between your old commission as well as your the fresh payment cannot equivalent genuine deals – a few of the differences is the outcome of stretching-out brand new remaining balance of your financing more an alternate financing identity.

Various other disadvantage of your quick, dirty, and harmful method is it can’t estimate the latest discounts you have made of the refinancing so you’re able to a beneficial fifteen-12 months home loan, as the even if the refinance loan will set you back $100,one hundred thousand smaller over their lifetime than the old loan, its fee is virtually indeed deeper.

step 3 Refinancing Conditions

Just as all house budget differs, for each and every refinance disease is different. If you should refinance depends on your circumstances additionally the bargain lenders render. And therefore of the following the around three activities is probab a?

Ditching Mortgage Insurance coverage

Emma’s Facts Emma ordered the woman family 36 months before getting $200,000, placing $10,100000 down and you will money $190,100000. Their rate of interest is actually 4.75 %.

Refinance Chance Emma is given a refinance mortgage in the step 3.75 percent which have refinancing costs charging $step 3,615. Her value of now is $232,100000, and her mortgage equilibrium is actually $180,771. She actually is undecided how much time she will remain this lady household, however, believes it might be no less than 3 years. Refinancing do lose her percentage by the americash loans La Veta $154, however it will need 33 days – almost three years – to recover the lady will set you back with a lower mortgage payment.

Should Emma Refinance? Emma’s residence’s well worth have preferred to the level you to definitely their mortgage-to-well worth is lower than 80 percent, which will let her lose the woman mortgage insurance fees. When the girl PMI advanced (.58 % a-year) are subtracted, Emma’s monthly payment falls of the $218 along with her breakeven is actually slash just to 21 months.

Opting for a higher rate to save cash

Established rate: 5.5% Provide step one Rates: step three.5% Provide step 1 settlement costs: $15,100000 Give 1 crack-even: 43 months Give 2 Rates: 4.15% Provide 2 settlement costs: $0 Render dos split-even: 1 month

Matt’s Tale Matt is actually a separated 30-something the master of a property he to begin with bought together with his ex-partner. He never got to refinancing that will be investing 5.5 percent towards an 7-year-old home loan. The remainder harmony out-of their $350,one hundred thousand loan was $303,933.

Refinance Options Matt was considering refinancing so you can a loan with a great 3.5 percent rates. Their percentage is certainly going off because of the $622 1 month! But not, new settlement costs to the the loan try over $fifteen,100, along with his breakeven section was 43 days. Matt’s not even sure how long he’ll remain his family, and is a king’s ransom to invest upfront – if he makes within just 2 yrs, he’s going to get rid of plenty.