Understanding Spread Betting

Spread betting is a derivative strategy, where participants do not own the underlying asset but speculate on its price movements. This type of trading allows you to take advantage of prices moving up or down. Essentially, spread betting offers investors an opportunity to trade across numerous financial markets such as indices, forex, commodities, and stocks.

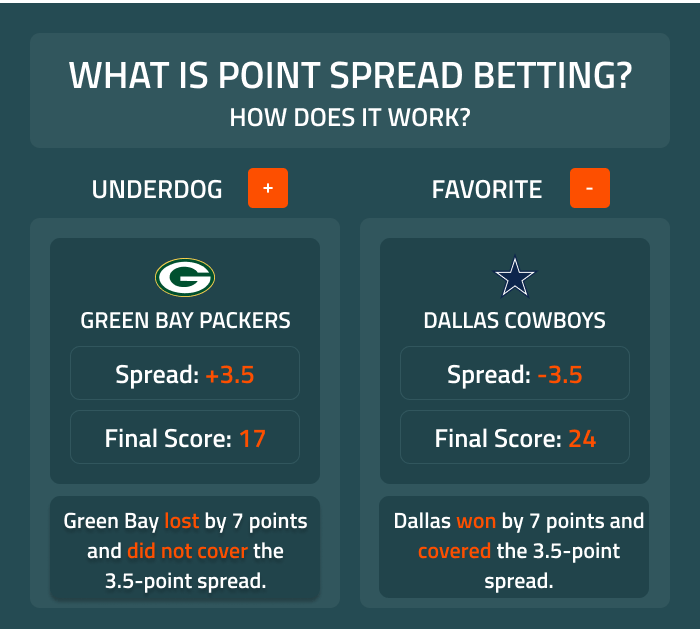

When you engage in spread betting, you’re placing a bet on whether you believe a financial instrument’s price will rise or fall. The provider presents two prices: the bid (selling price) and the ask (buying price). The difference between these two values is known as the “spread.” To initiate a trade, you must decide whether to go long (speculate that the price will rise) or go short (speculate that the price will decrease).

Key Components of a Spread Bet

Before making a trade, it is crucial to understand the components that make up a spread bet. First, as mentioned, there’s the spread itself which is effectively the broker’s fee for executing the trade. It is important to look for competitive spreads to minimize transaction costs.

Secondly, the size of the bet per point movement needs consideration. In spread betting, you decide how much money you are willing to bet per point change in the underlying asset’s price. For instance, if you bet $10 per point, and the asset price moves 20 points in your favor, you would gain $200.

A third critical component is the ability to use leverage. Leverage allows you to take a larger position than the initial capital you deposit, potentially amplifying profits. However, it’s equally important to understand that leverage can also magnify losses.

Choosing a Market and Asset

Choosing the right market and asset is vital. Most providers offer a wide range of instruments including commodities like gold and oil, currency pairs such as EUR/USD, stock indices like the S&P 500 or tech stocks, and many more. Each of these markets carries its own set of risks and opportunities so it’s important to choose one that aligns with your knowledge level and risk tolerance.

For beginners, it might be wise to start with markets that are less volatile and better understood. For instance, major currency pairs in the forex market or well-known stock indices can be a good starting point as they tend to have ample liquidity and tighter spreads.

Making Your First Trade

To execute your first trade, you’ll typically follow these steps:

1. Choose a reliable spread betting provider.

2. Open and fund your account read review according to the provider’s guidelines.

3. Select the market and specific asset you wish to trade.

4. Determine the direction of your trade. Decide if you want to ‘buy’ (go long) if you expect the asset to rise in value, or ‘sell’ (go short) if you expect it to fall.

5. Set the size of your bet per point movement.

6. Use tools provided by the platform to manage risk, including stop-loss and take-profit orders.

A stop-loss order is an important risk management tool. It automatically closes your position at a predetermined level if the market moves against you, thus capping your potential loss. Similarly, a take-profit order can be used to lock in profits by closing the position once the market reaches a favorable level.

Monitoring and Closing Your Position

After you have opened your bet it is crucial to monitor market movements and manage your position appropriately. Many platforms offer real-time charts, news feeds, and various analytical tools to help you understand market sentiments and potential price movements.

To close your position, you execute a trade equal and opposite to your open bet. For example, if you initially ‘bought’ 5 contracts, you would ‘sell’ these 5 contracts to close the position. Upon closing, the profit or loss is realized based on the number of points the asset has moved multiplied by your stake per point.

Risks and Benefits of Spread Betting

Risks

The primary risk in spread betting is the potential for significant losses, especially if leveraging is used. Without appropriate risk management, a small move in the opposite direction of your bet can result in hefty losses. Unlike traditional investing, you can lose more than your initial stake.

Market volatility can also amplify risks. Unexpected news or events can cause sharp market movements. In such circumstances, markets can gap over stops, resulting in larger than expected losses.

Benefits

On the positive side, spread betting offers tax-free profits in many jurisdictions, meaning gains are not subject to capital gains tax. This is dependent on local tax laws, so consulting with a financial advisor is advisable.

Spread betting also provides access to a wide array of markets and the ability to go both short and long. This flexibility means traders can profit in both rising and falling markets. Furthermore, the use of leverage, if managed correctly, can be a powerful tool to increase potential returns.

For those considering spread betting, it’s imperative to educate oneself thoroughly before diving in. Understanding market dynamics, careful selection of assets, diligent risk management, and starting with small stakes can all help mitigate the risks associated with this type of trading.