What is a great HomeReady Mortgage?

If you’re a decreased-to-modest money debtor that have a good credit score seeking a different sort of domestic, it could be value looking at the fresh HomeReady home loan paid because of the Fannie mae. That it financial, similar to the Household You are able to program given by Freddie Mac, allows for a step three% down-payment as opposed to the quality 20% that. The fresh new costs given towards an excellent HomeReady financial is superior to otherwise comparable to standard pricing to your a mortgage.

Key Takeaways

- HomeReady are a federal national mortgage association system to have low-income consumers.

- It offers low-down repayments, lower financing can cost you, and you can low mortgage insurance costs.

- Consumers enjoys freedom within the getting the financing for down money.

- A broadly equivalent program off Freddie Mac is known as Home You are able to.

- Eligible individuals just need an effective 620 credit rating so you can meet the requirements, regardless of if scores of 680 or maybe more often earn her or him top speed alternatives.

- Down-payment numbers are 3%, far lower than simply very mortgages.

How HomeReady Mortgage loans Really works

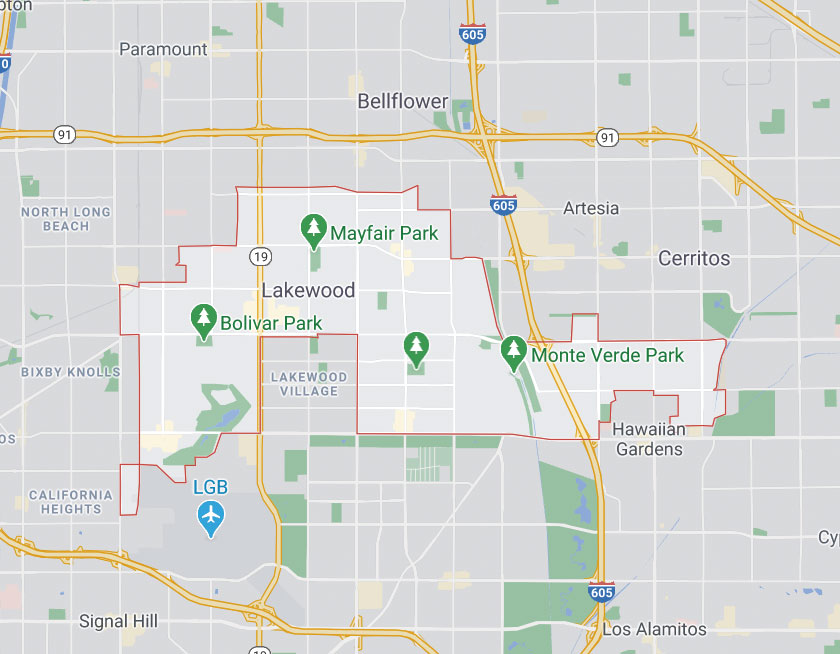

New HomeReady program is available to basic-some time recite homebuyers, along with those seeking refinance a current mortgage. Eligible consumers should have fico scores regarding 620 otherwise better, and people that have scores of 680 or maybe more get discovered actually ideal rates. Continua a leggere The problem of compliant mortgage restriction is the fact in some parts of the fresh new U