What is a great HomeReady Mortgage?

If you’re a decreased-to-modest money debtor that have a good credit score seeking a different sort of domestic, it could be value looking at the fresh HomeReady home loan paid because of the Fannie mae. That it financial, similar to the Household You are able to program given by Freddie Mac, allows for a step three% down-payment as opposed to the quality 20% that. The fresh new costs given towards an excellent HomeReady financial is superior to otherwise comparable to standard pricing to your a mortgage.

Key Takeaways

- HomeReady are a federal national mortgage association system to have low-income consumers.

- It offers low-down repayments, lower financing can cost you, and you can low mortgage insurance costs.

- Consumers enjoys freedom within the getting the financing for down money.

- A broadly equivalent program off Freddie Mac is known as Home You are able to.

- Eligible individuals just need an effective 620 credit rating so you can meet the requirements, regardless of if scores of 680 or maybe more often earn her or him top speed alternatives.

- Down-payment numbers are 3%, far lower than simply very mortgages.

How HomeReady Mortgage loans Really works

New HomeReady program is available to basic-some time recite homebuyers, along with those seeking refinance a current mortgage. Eligible consumers should have fico scores regarding 620 otherwise better, and people that have scores of 680 or maybe more get discovered actually ideal rates. HomeReady also offers affordable financial insurance.

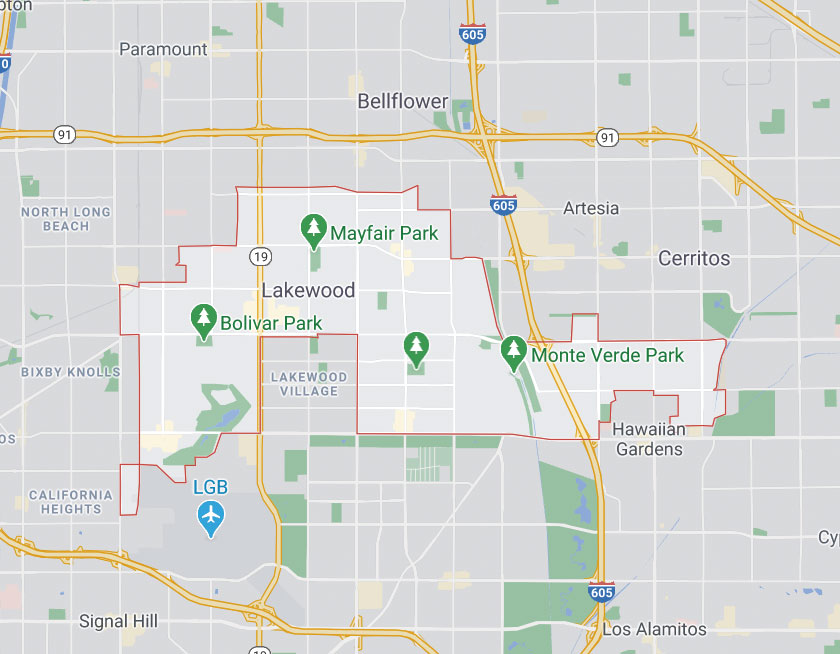

Qualified individuals are the ones whose earnings is actually 80% or a reduced amount of the space median income (AMI) towards census tract where in actuality the home is located, by . This condition boasts properties inside reduced-money census tracts. A debtor within the HomeReady system will also have control passions various other qualities. Still, one ones other services could be funded whenever closure towards a good HomeReady home loan.

Society Moments is actually 2nd mortgage loans which can be familiar with financing down money and settlement costs on very first mortgage loans that will be delivered to Fannie mae.

Great things about a good HomeReady Mortgage

Also a low down payment of step 3%, HomeReady mortgages bring much better than otherwise comparable to simple mortgage cost. The application form also offers lower than simple mortgage insurance conditions if the loan-to-really worth (LTV) proportion was between 90% and you will 97%, in addition to feature to your borrower so you’re able to cancel month-to-month mortgage insurance payments if LTV ratio falls below 80%. While doing so, this new borrower is not needed to make use of the very least number of individual loans towards the deposit and you can closing costs but alternatively could possibly get faucet almost every other present for example presents, grants, and you will Area Moments mortgages.

Another important advantageous asset of brand new HomeReady mortgage ‘s the self-reliance off its words. Whenever you are money restrictions could possibly get apply for all individuals, an excellent HomeReady mortgage need not be only throughout the term of them which take the structure. Mothers or other friends tends to be co-borrowers, even if they won’t thinking about residing in your house. If a household intends to purchase property that have an affixed local rental unit, they’re able to use the possible local rental earnings since an equation inside the the qualification to boost their qualification toward mortgage.

Criticism away from good HomeReady Mortgage

Whenever you are HomeReady mortgage loans has actually several masters, you will find several drawbacks. After you pick property using HomeReady, you will find limitations into the count you might borrow. This method (through Fannie mae) spends FHFA’ss conforming financing limitation, which by 2022, is actually $647,200 to own one unit property regarding the contiguous United states. If you purchase a property for the Their state, Alaska, Guam, and/or You.S. Virgin Countries, the quantity jumps to $970,800. S., especially on shores, housing costs, even for affordable property, are a lot americash loans Talladega Springs more than the conforming limit due to the fact put by FHFA.

Yet not, its really worth listing you to in a few areas where 115% of your median family value exceeds brand new conforming mortgage limit, it will be more than the fresh new baseline maximum. The loan ceiling throughout these elements for example-tool qualities in high-rates parts increases so you’re able to $970,800. Although not, just because you might borrow that it number, when you find yourself life toward a reduced-to-average income, it can be high-risk to take out that loan that you might not be able to manage even although you manage qualify because of it on paper.

Unique Factors

There are even advantages to have loan providers whom participate in HomeReady mortgage loans. Including, Fannie Mae’s Desktop computer Underwriter (DU) system instantly means finance that can easily be entitled to HomeReady, while offering a card risk testing.

Lenders may also discovered exposure-created costs waivers getting consumers that have fico scores regarding 680 or higher and you may LTV percentages over 80%. HomeReady finance can and basic loans inside the financial-recognized safeguards (MBS) swimming pools and whole loan commitments.